The bidding wars convulsing many areas are reportedly driving more home buyers to consider a somewhat cynical tactic: making offers on multiple homes simultaneously. Is the tactic kosher? Some agents shake their heads vigorously, condemning the practice as unethical and counterproductive. But others ... » Learn More about Should a buyer make offers on multiple homes simultaneously?

Moving

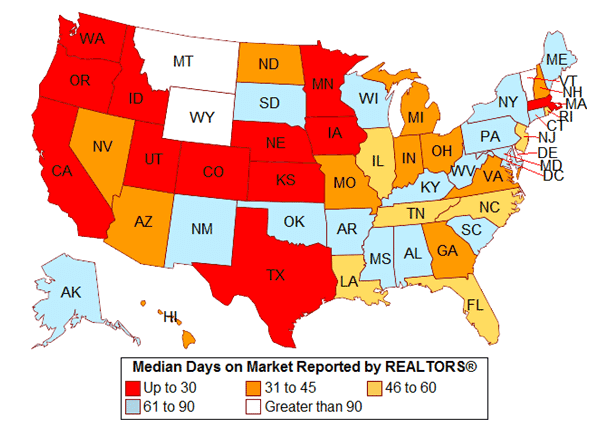

States Where Homes Sell in under a Month

In a few locales, at least half of the properties sold between March and May were on the market for 1 month or less, according to the latest REALTORS® Confidence Index Survey Report. Properties sold the fastest in 12 states: California, Colorado, District of Columbia, Idaho, Iowa, Kansas, ... » Learn More about States Where Homes Sell in under a Month

Where are home prices so high it’s truly unaffordable

Home prices are going up all over the U.S., and since demand also increases, affordability is actually a growing problem. Home prices continue to increase nationwide, even hitting new highs in a number of large housing markets in April, as outlined by S&P Dow Jones Indices Case-Shiller Home ... » Learn More about Where are home prices so high it’s truly unaffordable

Fifth Third Mortgage offers mortgage with no down payment

Fifth Third Mortgage could be the latest lender to enter the slowly growing playing field of mortgage companies offering low down mortgages, taking it one step further by announcing - for those who qualify - a zero down payment mortgage program. Its down payment assistance program offers 3% of the ... » Learn More about Fifth Third Mortgage offers mortgage with no down payment

Jumbo mortgages now less expensive than smaller loans

Banks will give you a better interest rate if you purchase a more expensive and, presumably, bigger home. The interest rate for a 30-year jumbo loan currently stands at 3.71 percent - a notch below the rate to get a "conforming" mortgage, which weighs in at 3.73 percent, says Greg McBride, senior ... » Learn More about Jumbo mortgages now less expensive than smaller loans