Seven years following the federal government first offered an alternative to assist some homeowners refinance into more affordable mortgages, the HARP program is being extended yet again, and plans for a new refinancing program will be completed.

U.S. is going to extend HARP home loan program

The Home Affordable Refinance Program, or HARP, already has been extended at least two times and was scheduled to end at the end of this year. But HARP continues through September 2017, the Federal Housing Finance Agency said.

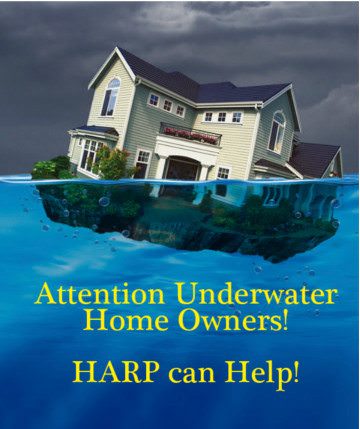

The program, begun as a result of the housing crisis, enables people who owe more than their home is worth, or who may have little equity, to refinance into a loan at current low interest rates. (The average rate for a 30-year, fixed-rate mortgage has hovered below 3.5 % for weeks. For the majority of 2008, it was about 6 %.)

In excess of 3.4 million homeowners have refinanced their mortgages under the program since it began, according to the housing finance agency, which oversees the mortgage giants Fannie Mae and Freddie Mac. About 18,000 borrowers refinanced under HARP while in the second quarter of this year, down from nearly 20,000 in the first quarter. Still, more than 323,000 loans are estimated to remain eligible for refinancing under HARP.

Erin Lantz, vice president for mortgages with the real estate site Zillow, said about 12 % of mortgaged homes remained underwater at the end of June. But borrowers may still not be aware that the HARP program exists, she said. Or, because they could have failed to qualify in the programs early years due to missed or overdue payments, they could think they remain ineligible.

Cora Fulmore, coordinator of the Florida Housing Counselors Network, said some borrowers remained wary, perhaps because of past tussles with lenders. Housing counselors have tried various outreach efforts to get customers to apply, she said, including going door-to-door and offering gift cards to borrowers.

There’s a lack of trust, she said. They’re not believing this program can help them.

Some borrowers could possibly be suspicious that HARP is simply too good to be true, or they will often simply not wish to take the time to apply, said Jay Plum, head of consumer and mortgage lending at Huntington Bank in Columbus, Ohio. The bank has made overtures to eligible borrowers, he said, going as far as to send HARP document packages to homeowners by overnight delivery.

He urged borrowers who might think they do not have refinancing options to take a look at the program, noting that it provides a streamlined application process that oftentimes does not require an appraisal. It truly is in their best interest, he said.

Madonna Barwick, 49, a teacher who lives in Canfield, Ohio, said a teller at a Huntington grocery store branch shared with her about HARP. She was able to refinance her mortgage last year, she said, lowering her payment per month by more than $300 and easing her financial worries. Her rate dropped to just over 4 % from in excess of 6.6 %. It was a blessing, she said.

Here are a few questions and answers about special refinancing options:

What loans are eligible for HARP refinancing?

Loans have to have originated on or before May 31, 2009, and must be owned or guaranteed by either Fannie Mae or Freddie Mac. The property will need to have a loan-to-value ratio the mortgage divided by the homes value of 80 percent or more. (A $140,000 house with a $130,000 mortgage would have a loan-to-value ratio of approximately 93%.) The borrower must have had no overdue payments in the previous six months, and no more than one overdue payment in the previous year.

Do I have to do a HARP refinancing with my current lender?

No. You should start by contacting your current loan servicer, but you should also check other lenders to compare rates and fees, said Ms. Lantz at Zillow. To discover participating lenders locally, search on the HARP website.

Bob Walters, chief economist with Quicken Loans, said borrowers should not hesitate to ask about HARP if a loan officer does not mention it: They need to certainly ask.

In what way will the new refinancing option available in October 2017 vary from HARP?

As with HARP, borrowers will generally have to be current on their payments. Unlike HARP, however, the new refinancing option will not have a cutoff date, so loans made after May 2009 may qualify. And unlike with HARP, borrowers are able to use the new refinancing option more than once.

The new offering will generally focus on mortgages with loan-to-value ratios of 95 % or better. Freddie and Fannie say they will announce more details in November.